Contributed by Patrick Chang, Senior Financial Consultant, Financial Alliance Pte Ltd (The contributor can be contacted at patrickchang@fapl.sg)

Note from Financial Alliance: This scenario analysis is contributed by the author to show you how inflation can derail a poorly thought-through retirement plan. The author demonstrates how inflation can be tackled in the course of retirement planning. You too can have your retirement planning done to your specifications. Do contact the author or your financial consultant at Financial Alliance to make sure your retirement plan is effective and meaningful to you. Alternatively, you may contact us at 6222 1889.

Assuming I am 40 years old, single, and planning to retire at age 65, and I am expected to live till 85. During the 20 years of retirement living, I estimate I will need $3,000 monthly to maintain my current lifestyle.

Another assumption: I do not have any savings or any investment to start with.

So how much do I need to retire?

The simple answer would be $720,000 ($3,000 x 12 months x 20 years). Sounds logical? Makes sense?

Most of us know that the answer is not correct.

To help me work out a more accurate retirement sum, which is supposed to last throughout my retirement years, I require more information. Let’s assume the long-term inflation rate is 3% and the long-term investment returns rate is 6%.

Based on these variables, the total retirement sum I need is $1,057,700, that’s nearly $340,000 more than the non-inflation and non-investment returns adjusted figure! Also, by the time I reach my retirement age, the inflation-adjusted monthly sum I need for retirement will have increased to at least $6,345, more than double the original figure of $3,000. And over the next twenty years thereafter, the figure will continue to go higher as it gets adjusted progressively for inflation.

What if the long-term inflation rate is 2%? Then the total retirement sum needed at the start of my retirement falls to $825,200 and the inflation-adjusted monthly retirement sum will then be $4,950.

Just a 1% change in the long-term inflation rate can have a significant impact on the total retirement sum needed.

That is why some economists call INFLATION a ‘monster’ that needs to be contained. A high inflation rate brings not just hardship and suffering to the people of a country but it can also throw its economy into disarray.

So, what can I do to ‘tame’ the inflation monster and reduce its impact on my retirement fund?

Simple. Get an investment with returns higher than the inflation rate as I have no control over the rate of inflation. I can construct a diversified investment portfolio to help me mitigate and reduce the risk of the negative impact of inflation on my retirement fund.

Therefore, putting the retirement fund into a purely deposit savings account is a bad idea because the interest gained from the account is well below the inflation rate, resulting in negative saving. With the current ultra-low saving interest rates given by banks, it means that the longer I save, the worse off, financially, I become.

Here is an illustration of what I mean:

| Savings Interest Rate – 1% | Long Term Inflation Rate – 3% | |

| Total amount | ||

| After 5 years | $105,100 | $115,800 |

| After 10 years | $110,500 | $134,400 |

| After 20 years | 122,000 | $180,600 |

What this table shows is, after five years, the real value (inflation adjusted) of the $100,000, will be $115,800 but I am only getting $105,100 from my savings account. It means I have lost $10,000 in real value over a short span of five years.

In the early 1970s, a cup of coffee in a typical neighbourhood coffee shop used to cost just $0.10. Today, I pay $1.20 for the same cup of coffee at the same neighbourhood coffee shop. So, if I have made plans, assuming that I am going to pay $0.10 for the cup of coffee for the rest of my life, then the money set aside for this purpose will run out much faster than expected.

So, to assume that I need just $3,000 for my retirement living, without considering the impact of inflation, I am going to be in for a rude shock. What I can do with my $3,000 today will be very different from what I can do with the same amount of money, say, 25 years or 45 years later.

So, if I have made plans to receive just a flat rate of $3,000 a month during my retirement – which starts 25 years later – and wanted it to last for another 20 years, what will be the real worth of the $3,000 then?

With an annual inflation rate of 2%, the $3,000 will be worth $$1,810 25 years later, and just $1,200 45 years from now.

At 3% inflation rate, the figure is $1,400 after 25 years and just $760 after 45 years.

At 5%, the sum drops further to just $830 at the 25 years mark, and a mere $300 in 45 years’ time.

The amount is grossly insufficient for me to maintain the lifestyle I would like to have.

My retirement ‘income’ must be in line with or exceed the prevailing long term inflation rate, otherwise, as I grow older, when I am at my weakest, both physically and probably mentally as well, my real income is at its lowest point.

That will spell disaster for my retirement.

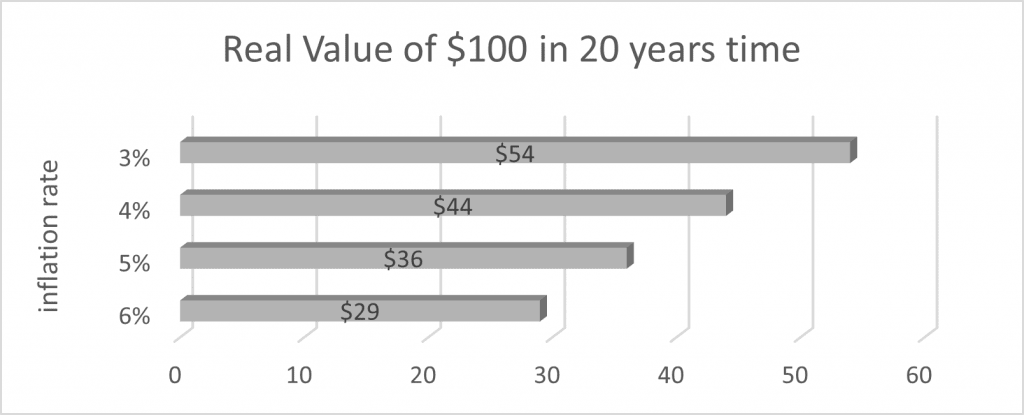

Here is a graphical depiction of how inflation can affect the real value of the $100 note I currently have.

So, I must look at the real retirement sum. What do I mean by that? Let’s refer to the earlier calculation. The current $3,000 is worth just $1,500 (in today’s value) in 25 years’ time if the long term inflation rate stays at 3% annually. This is the real sum.

But the future $3,000 – without making any adjustment for inflation and assumed to be the same $3,000 – is known as the “nominal sum”. This sum does not reflect the reality of the changes in the purchasing power of the money.

So, theoretically, when inflation is rising, real income and purchasing power fall by the amount of inflation on a per-dollar basis.

Therefore, it is critical to understand and appreciate the impact that inflation can have on my retirement sum and prepare adequately for it.

The next consideration now is: How to help myself get to the required retirement sum? Should I start investing now? Or can I choose to start later? How would this decision affect my savings or investing?

Here is where the second ‘I’ comes into the picture: INTEREST rate.

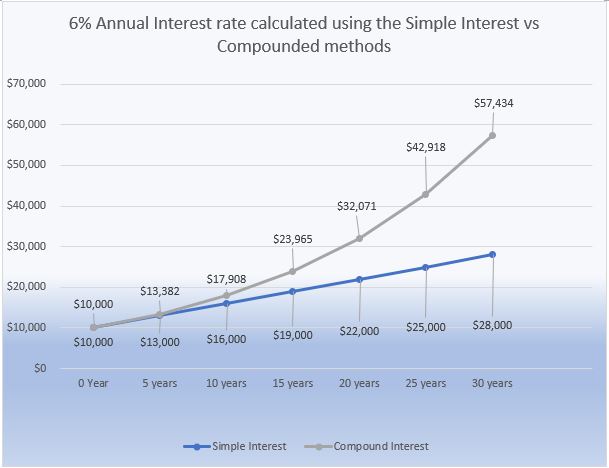

The interest rate plays a pivotal role in wealth accumulation, especially when it is compounded. Compound interest is calculated on both the principal sum and the accumulated interest from previous periods. Compounding enables the money to grow faster, unlike simple interest, which is calculated by considering only the principal sum.

The graph below is a simple illustration of how compound interest can help grow my $10,000 much faster than simple interest:

The difference may not be obvious in the initial years. But as time passes, the difference in returns becomes more staggering.

The magic of compounding can work to your advantage when it comes to your investments, making compounding a potent factor in wealth creation.

As such, the earlier I start investing, the more benefit I can derive from the compounding interest. Here is an example:

Let’s say if I want to retire in 20 years’ time, but I only want to stay invested for 10 years, what is the material difference between starting to invest now and waiting for another 10 more years before starting?

If I invest $12,000 per year from year 1 to year 10, with 5% returns a year, I would have accumulated $322,181 at the end of 20 years.

But if I wait and start only at year 11 and end at year 20, with the same 5% returns, my wealth can only grow to $197,850.

So, it is obvious that the earlier I start investing, the better my financial position will be for my retirement.

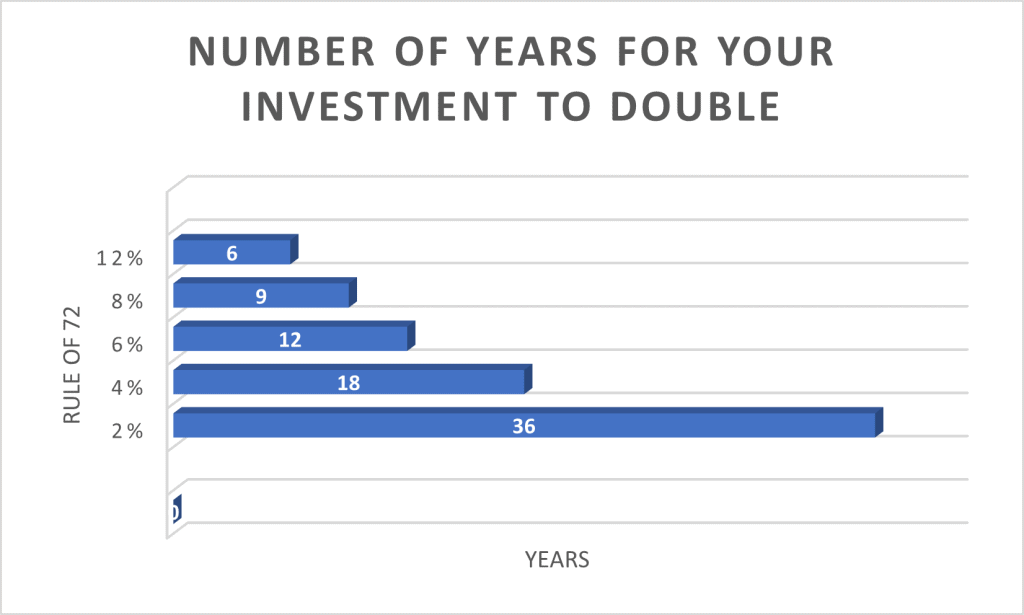

The dramatic effects of time and compounding interest can be illustrated best by the simple yet powerful concept of the ‘Rule of 72’, which illustrates how amazingly money can compound if I am prepared to give it enough time to grow.

The rule says that dividing 72 by the interest rate (or the investment returns rate) would tell me the estimated number of years required to double my money.

Here is the formula:

72 divided by an assumed rate of return = years it takes to double

72 divided by 10% = 7.2 years to double

And with this formula in mind, I can gauge how soon I can possibly double my investments and make appropriate financial plans for my retirement.

But as in most things, there are always two sides to the same coin. Compound interest can be a double-edged sword too. It depends on which side you are on. If I am a saver, then all is good and fine. My fund can grow faster.

But if I am a borrower and am being charged with compound interest for the loan and debt I incurred, then if I do not pay them off fast enough, I could be buried by interest payments alone – and this would not just hinder my retirement plan.

The plan would also not achieve its desired outcome, despite the retirement plan being well-planned beforehand, as I would have been saddled with high compounded interest debt.

Here are some simple calculations and scenarios on how a $10,000 credit card debt can partially ruin my retirement plan if I am not careful.

| Existing Balance | $10,000 | $10,000 | $10,000 | $10,000 |

| Monthly Payment | $300 | $500 | $800 | $1,000 |

| Interest paid | $6,641 | $2,891 | $1,616 | $1,265 |

| Interest paid | 56 | 26 | 15 | 12 |

| Total payment | $16,641 | $12,891 | $11,616 | $11,265 |

Imagine all these interest payments are invested for 5% annualized returns, it can make a difference to my retirement fund.

For example: by investing the $6,641 over a period of 56 months instead of paying it off as interest payments, that figure increases to $7,493. It becomes a positive return, not a negative payout.

Therefore, the compounded interest rate is just like the sea. Its powerful waves can carry a boat to its destination, but it can also sink the boat when it gets turbulent. As the Chinese saying goes: 水能载舟,亦能覆舟。

So, stay out of debt – especially those with high compounded interest debt that are marketed to consumers, such as credit cards and other forms of unsecured loans – if a financially secure retirement is the goal to achieve.

It is no wonder that Albert Einstein once said: “Compound Interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t…pays it.”

In conclusion, when I am planning for my financially secure retirement, I have to consider and make provisions for the two critical ‘I’s. Both ‘I’s, the ‘Inflation rate’ and the ‘Interest rate’, are capable of creating havoc to my well-planned retirement or, on a more positive note, taking my retirement to a higher level of financial adequacy.

Making both ‘I’s work for me and not against me is, therefore, a top priority in my retirement planning.