Contributed by Kenny Loh, Senior Financial Advisory Manager, and Chew Hock Beng, Financial Advisory Director, Financial Alliance Pte Ltd (The contributors can be contacted at kennyloh@fapl.sg and chewhockbeng@fapl.sg)

Note from Financial Alliance: This case study is contributed by the authors to show you how they assessed a real-life case. By combining their financial advisory expertise and resourcefulness with their deft use of Financial Alliance’s proprietary financial planning tools, they demonstrate how they structured their recommendations to fit the situation and retirement goals of the client. You too can have your financial planning done to your specifications. Do contact the authors or your financial consultant at Financial Alliance to make sure your financial plan is effective and meaningful to you. Alternatively, you may contact us at 6222 1889.

The Client & Her Concerns

Michelle (not her real name) is a 43-year-old Singaporean Working Mother with 1 young child. She is the sole bread winner for the family as her husband is not working due to a medical condition. Michelle is a Regional Finance Director earning an annual income of $200,000 in an American Bank.

Michelle has concerns over her retirement planning as she is worried about her job security and she hardly has any extra savings to set aside for her retirement. She only has about $6,000 savings every year as she has huge financial commitments for her family, children and mortgage payments.

Kenny conducted the following KYC (Know Your Client) and fact-finding to understand her current financial situation before making recommendations for her retirement planning.

- Financial Health Check

- Wealth Protection

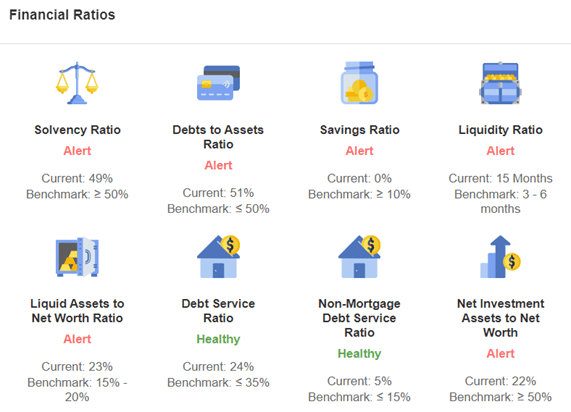

After Michelle provided Kenny her Personal Income Statement and Net Worth Statement, Kenny found her financial ratios to be as follows:

Based on the financial ratios, Kenny provided a few recommendations to Michelle for improvement:

- Maximise the returns on lazy money which is sitting in the bank receiving 0.05% interest rate.

- Make the money work harder by investing the idle money to at least beat inflation.

- Should not incur more debt.

- Find ways to reduce personal expenses and family expenses to free up more cash flow to build an investment portfolio for retirement.

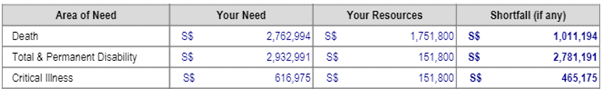

Kenny did a simple Insurance Portfolio Audit and highlighted the Wealth Protection gaps to Michelle, advising her to get sufficient wealth protection against Death, Total Permanent Disability and Critical Illnesses. Kenny highlighted that any unforeseen expenses will derail her retirement plan.

Retirement Planning

The following are the detailed planning parameters for Michelle.

Retirement Age: 60-year-old

Life Expectancy: 85-year-old

Monthly Expense = S$4,000

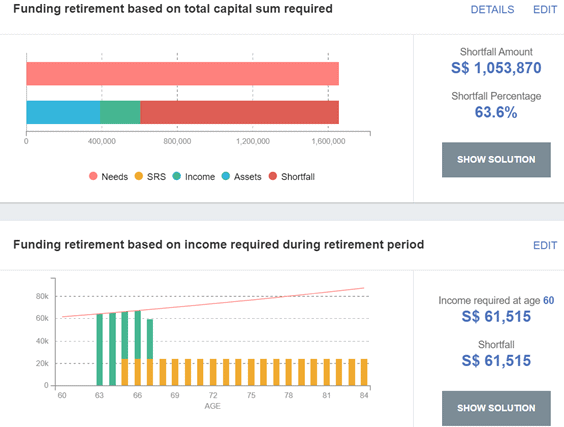

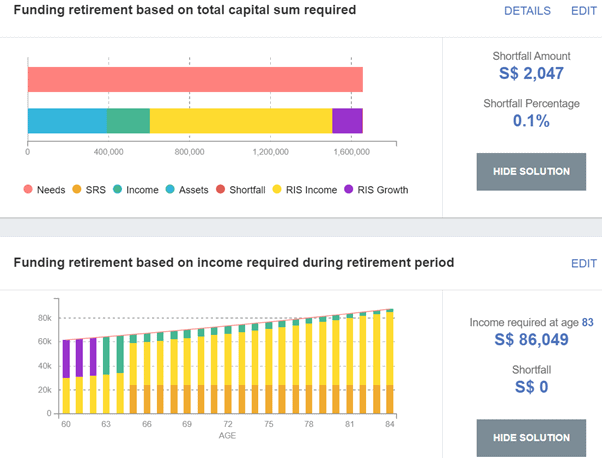

- Total Retirement Fund Need (60 to 85-year-old, Expense inflation adjusted) = SS$1,656,863

- Current available resources

- CPF OA & SA about S$S160,000. Assumption: Michelle has to work until age 60 and be able to accumulate enough (close to S$300,000 Enhanced Retirement Sum) by age 55 to enrol into CPF Life, which can provide about $2,000 monthly income perpetually)

- Current Shares investment of $93,000

- Retirement Funding Gap = S$1,053,870

Advice Provided (to Fill the Retirement Funding Gap)

A Retirement Income Solution consisting of Fixed Income (Guaranteed) and Inflation Hedged Income (Non-Guaranteed but with growth potential) is considered:

- Fixed Income with CPF Life (Monthly $2,000 payout) – Perpetual

- $600,000 Dividend Portfolio (REITs and Income Generating Investment) with 3% p.a. growth to hedge inflation (Monthly $2,500) – Perpetual

- Growth Portfolio to fill the funding gap – to be drawn down

This retirement portfolio also serves the purpose of the estate planning & wealth distribution because the $600,000 Dividend portfolio can be passed on to the next generation upon death. The distribution method can either be written in a will (for immediate distribution) or be set up in a Testamentary Trust (for delayed distribution).

Options to Save for Retirement

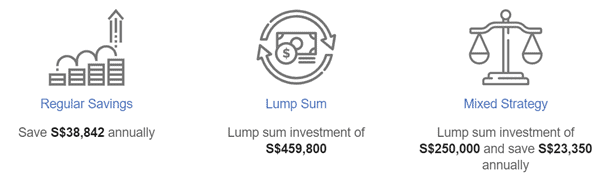

There are 3 options for the client to save for retirement:

- Option A: Lump Sum Investment: $459,800

- Option B: Regular Annual Saving: $38,842

- Option C: Lump Sum Investment with Regular Annual Saving: Initial sum of $250,000, together with a regular annual saving of about $23,350

A Holistic Retirement Plan and Recommendation

After analysing Michelle’s personal cashflow statement and net worth statement, current financial resources and family situation, the following recommendations are made to Michelle.

- Option A and Option B are out as Michelle does not have enough financial resources.

- Option C is a more viable solution as Michelle has S$250,000 cash savings but the annual investment of $23,350 (about $2,000 per month) is a challenge to her. Michelle has to take immediate action to reduce unnecessary expenses to free up more cash to invest for her retirement.

- As Michelle has achieved the maximum tax relief ($80,000) of her personal income tax, Michelle does not need to contribute to SRS (Supplementary Retirement Sum) as there is no further tax saving.

- Michelle has to set aside about $60,000 cash as emergency fund (6 months of $10,000 monthly expense) before deploying her cash for investment.

- Michelle needs to accumulate up to $300,000 in her CPF OA + SA by 55-year-old (in the next 12 years)

- As Michelle is the sole breadwinner of her family, she has to bear all the medical expenses if any family member incurs them. Protecting wealth is the first priority. Michelle was advised to conduct a detailed Insurance Portfolio Audit (for herself and her family) with the objective of maximising the protection with limited financial resources. This is to hedge the investment portfolio to avoid any liquidation due to unforeseen events which will derail the retirement planning.

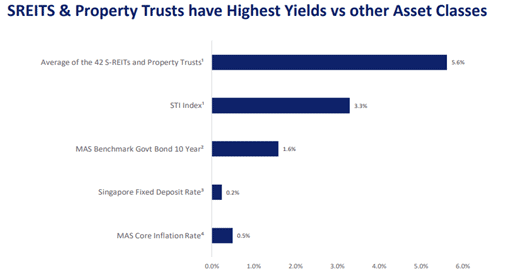

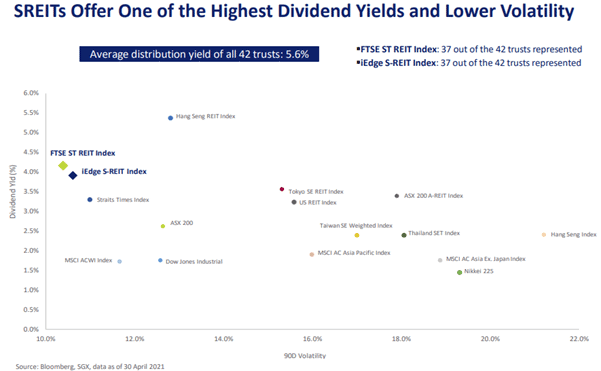

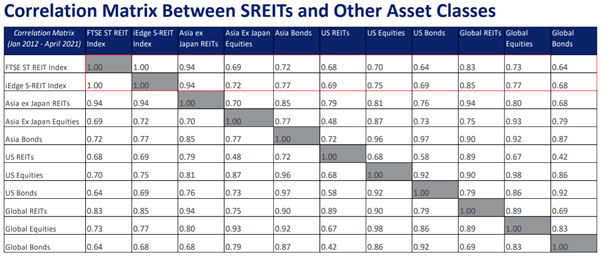

- Implement an actively managed REIT portfolio (between 8-12 REITS) with the focus on Passive Income Generation of 4%-6% annual dividend. Singapore REITs have one of the highest dividend yield and lowest volatility compared to other stock markets. Moreover, they have a low correlation to other asset classes.

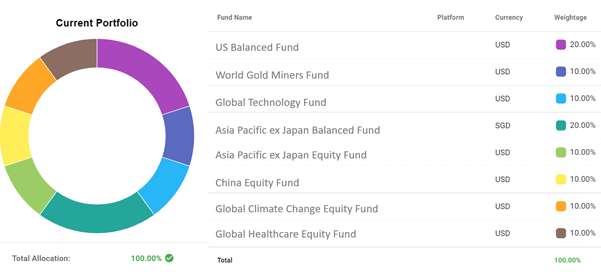

- Implement a Diversified Growth Portfolio (target 7-8% p.a. return with Moderate Aggressive Risk Profile) with a monthly Regular Saving Plan to grow the capital.

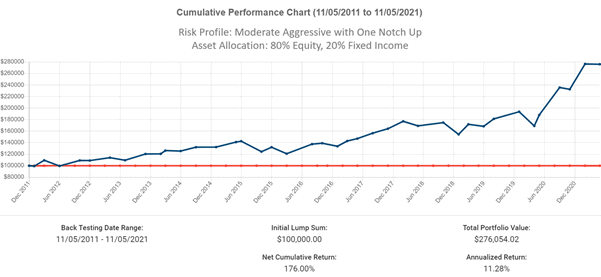

Conducted Back Test (10 Years) to check whether the constructed portfolio is able to deliver 8% p.a. expected return. The back test’s result (10 years’ data) showed that the recommended portfolio delivered an 11.28% annualised return.

Note: Past performance is not an indication of future performance.

- If Michelle loses her job or is unable to generate income from working, and based on her current financial and cash flow situations, Michelle has to consider downgrading from her private condominium to HDB in order to free up cash and also reduce or eliminate her monthly mortgage liability.

Author

Kenny Loh is a CERTIFIED FINANCIAL PLANNER and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and an invited speaker at the REITs Symposium and Invest Fair.

Co-author

Chew Hock Beng is a Certified Financial Planner, Chartered Financial Consultant, Chartered Life Underwriter & Chartered Family Office Specialist. He has community involvement experience and has held appointments like Honorary Treasurer & Exam Board Chair with Financial Planning Association of Singapore (FPAS), Education Sub-committee with IFPAS, PSG Chairman. Hock Beng is a certified IBF instructor with Financial Perspectives and an Adjunct Trainer with Falco Academy. Currently he is managing a team of independent financial adviser representatives, providing training, mentoring & coaching