Contributed by MK Chan, Corporate Development Director, Financial Alliance Pte Ltd

(The contributor can be contacted at mkchan@fa.sg)

Do you want your financial consultant to listen to you and understand your goals and situation?

Do you want to have your problems solved by solutions that are relevant and reassuring to you?

If you said, “Yes”, you are in good company. Generally, as clients, individuals and businesses would answer the same way. So would we at Financial Alliance.

Being managed by veterans with decades of client-relationship-building experience, Financial Alliance knows clients don’t want consultants to pitch products, especially irrelevant ones. Some clients want to learn along the way, and a competent and updated financial consultant would be perfectly placed to educate them.

A financial consultant who possesses the qualities to fulfil clients’ needs is in a much better position to assure the clients that their concerns are being appropriately addressed, giving them the confidence to entrust their financial future to him/her.

Now, what if we told you that Financial Alliance, in line with its perennial push for purposeful independent financial advice, annually honours its financial consultants who meet minimum levels of these qualities?

Yes, since 2002 when the independent financial advisory (“IFA”) firm was established, Financial Alliance has been busy grooming financial consultants to provide purposeful advice to their clients by focusing on overall quality.

A UNIQUE BROAD-BASED RECOGNITION – FOR VALUES THAT MATTER TO CLIENTS

“Financial Alliance Quality Class”, or “FAQC”, is the name of the broad-based recognition. FAQC is in a class of its own. It is not one of those awards commonly seen in newspapers – whose eligibility criteria are – or rather, criterion is – based on sales or income alone, such as the “Million Dollar Round Table”.

Wealth Management Director Ms Michelle Ee said, “To qualify for FAQC, the practitioner has to demonstrate competency in knowledge and professional standard. For example, he or she has to be competent enough to analyse the input from a client and prescribe what is necessary. The client may have the final say, but the expert analysis should still be done and presented. With this, the client makes a decision knowing what he is getting into or missing out.”

(For a better understanding of FAQC’s eligibility criteria, please refer to The Box at the end of this article.)

Financial Alliance is proud to confer recognition on financial consultants who consistently demonstrate these win-win qualities. Every year, Financial Alliance honours FAQC qualifiers at a special occasion. In 2019, 77 financial consultants were honoured at its Awards Nite.

With so many qualifiers, is it easy to qualify?

“It’s not so much about being easy to qualify,” said Mr K L Tang, Director of Strategic Partnerships and Business Development. “It’s more about the alignment of priorities. If the financial consultants’ priorities, conduct and performance are aligned to FAQC’s desired qualities, then qualifying is a natural consequence. FAQC is significant in Financial Alliance as it reflects our philosophy of providing sound independent financial advice. Qualifying for FAQC is what everyone is encouraged to do.”

Associate Wealth Advisory Director Mr Alvin Low, who joined Financial Alliance in 2011 and has qualified for FAQC since 2016, said, “Attaining this award gives me, a practitioner offering independent financial advice, a sense of genuine achievement. Going beyond sales, it embodies perseverance, discipline and hard work, so it is a true pinnacle of professional success. In fact, to qualify for the FAQC, a financial consultant has to engineer a paradigm shift in mindset to be more professional when giving financial advice. The award not only codifies the principles of quality of advice in a clear and unambiguous language, it has also reshaped my thinking and behaviour to do more good for the client.”

As you can tell by now, it is impossible for someone who focuses only on sales to qualify for FAQC. In fact, someone who merely focuses on sales may find that they will never qualify for it. The reality is, FAQC is not meant to celebrate stellar sales performance. Instead, FAQC celebrates the quintessential practitioner.

THE QUINTESSENTIAL PRACTITIONER

FAQC honours discipline, competence and a genuine pro-client mindset. It is designed to nurture a breed of quintessential practitioners who possess such a broad-based mentality. With it, as Mr Tang has said earlier, a practitioner will find it more natural to qualify for FAQC than one with a sales-only mentality.

Moreover, FAQC is not an award for the best performing individual in a cohort. Instead, it is for all who meet the requirements and whose output meet clients’ requirements and withstand scrutiny.

All-rounded practitioners who add value to their clients professionally and competently are the ones Financial Alliance seeks to create. The company encourages every single one of its consultants to make it to the FAQC family regardless of background and prior experience. When they get there, they are encouraged to stay in it consistently, year after year.

The presence of serial qualifiers – and there are quite a few – proves that it is possible for practitioners to possess the tenacity to grow their financial advisory practice healthily.

A six-time serial qualifier, Associate Wealth Advisory Director Ms Adeline Yeo, who has qualified every year since she joined Financial Alliance in 2013, said, “When I first started in Financial Alliance, I made a commitment to my clients that establishing business relationships with them would only be the beginning – the first step – of a lifetime relationship we would build. Now, the award is an affirmation of my work. Not only does my professional practice provide a reasonable lifestyle for my family, it also generates tremendous value to my clients who have entrusted to me their financial planning matters. This responsibility motivates me to qualify year after year as I want to grow my business practice to serve my clients better.”

In addition, Mr Victor Chong, Financial Advisory Manager, who joined Financial Alliance in 2015 and has qualified for FAQC for all 3 years in a row since then, said, “Qualifying for FAQC is a testament to my personal commitment to always be my best and do the right thing for clients. It clearly tells me that the responsibility of raising professional standards and practices rests on my shoulders, and the qualitative factors of my work make a difference to the clients I serve. I feel humbled and thankful to be recognised for my efforts.”

THE MORE CONSULTANTS QUALIFY, THE MORE CLIENTS WIN

FAQC may only be open only to the financial consultants of Financial Alliance, but the clients are clear winners too. The presence of FAQC gives the financial consultants a worthy goal they can aim for. Even by just aiming for it, their clients get to benefit regardless of whether they qualify in a given year or not.

In Financial Alliance, consultants are encouraged to do their best to qualify every year. Those who miss certain criteria in one year are encouraged to try again the following year. FAQC is not an elite club reserved for an exclusive handful. It is meant for all.

Senior Consultant Jillinda Hoan, who joined Financial Alliance in late 2014, qualified for FAQC for the first time in 2018, said, “Finally achieving FAQC helped me to see that working hard consistently and not giving up will eventually lead to good results. This motivates me to continue to work hard and never stop learning for the greater benefit of my clients.”

Financial Alliance’s co-founder and Managing Director Mr Vincent Ee said the FAQC qualifiers bring to life the IFA concept, adding, “Financial advisory services is a tough business to be in, but the FAQC qualifiers manage to adhere to the high touch to achieve success. I consider them heroes.”

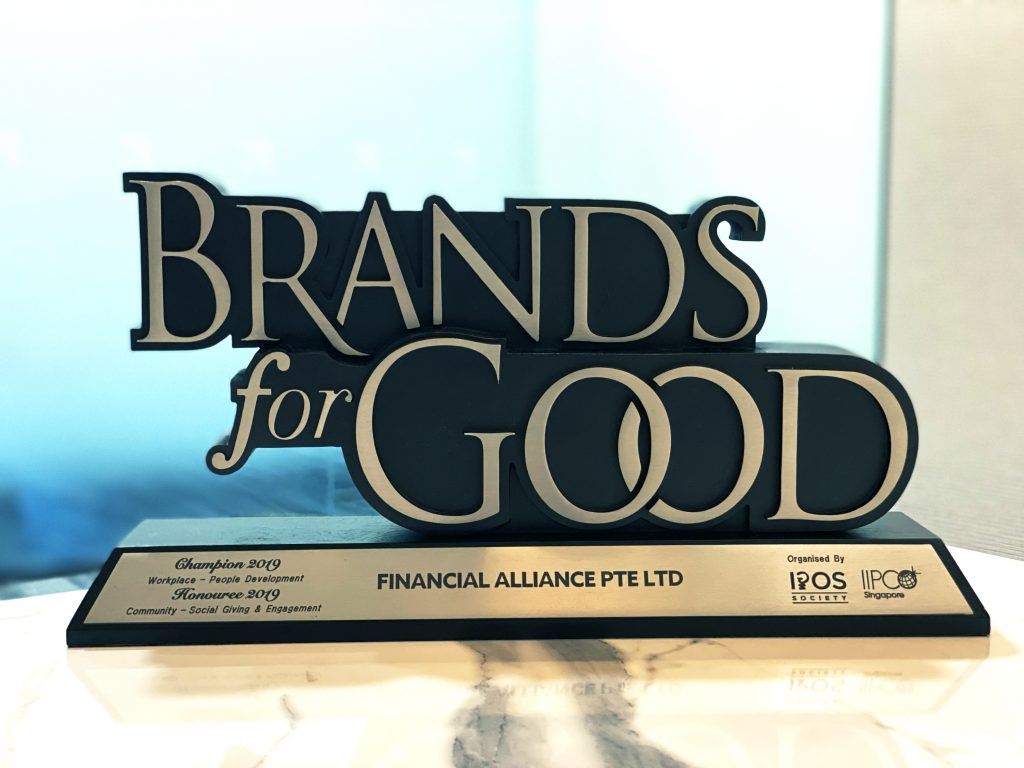

FAQC is in line with our never-ending quest for overall quality, so it aligns well with Financial Alliance’s Singapore Quality Class Star status.

Financial Alliance first acquired the Singapore Quality Class and People Developer statuses in 2008, and has successfully renewed them whenever they expired. Since 2012, Financial Alliance has been upgraded to Singapore Quality Class Star status, putting Financial Alliance alongside esteemed organisations such as Ministry of Finance, Fei Yue Community Services, MUIS and Mandarin Oriental, just to name a few.

KEEPING FAQC RELEVANT

FAQC has come a long way from 2004 (when the first such recognition was given, albeit under a different name), when only 2 financial consultants qualified. They represented about 5% of the company’s financial consultants back then. In the last seven years, about 25% qualify for FAQC each year. Although relatively stable, this percentage is very encouraging when viewed in the context that the number of financial consultants today is almost double of that in 2012.

Moreover, the eligibility criteria of FAQC have risen and expanded over the years to keep the recognition relevant to the prevailing times, mood and regulations. The most recent criteria expansion was the inclusion of MAS’ Balanced Scorecard criteria in 2016.

Ms Ivy Tan, our Associate Director who joined Financial Alliance in April 2007, is among the rare few who has seen the FAQC bar raised over the years. Despite the increasing difficulty in qualifying, she has qualified for FAQC every single year since 2007. She said, “Consistently making it to FAQC reflects my earnest desire to fulfill my personal potential for my clients even if the bar is raised. I am passionate about what I am doing as a financial advisory practitioner, and I am delighted that my effort to meet my clients’ needs and goals is worthy of recognition. I want to be an important person to my clients and a role model for the financial consultants in my team. Their respect and recognition spur me to accomplish even more.”

What is promising is that, although qualifying has become progressively more difficult, more and more are qualifying. This validates our effort to create a pool of dynamic professionals. We are aware that the acts of a rogue financial consultant is shared more readily and through more channels than the acts of one who does his or her job well. This could easily lead to the mistaken belief that genuinely “pro-client” financial consultants don’t exist, or they are the minority if they exist. Minority or not, Financial Alliance nevertheless wants to nurture the client-centric attitude among practitioners so that more clients can benefit. Uplifting the overall quality of their practice is where FAQC serves its ultimate purpose.

As FAQC is a manifestation of Financial Alliance’s never-ending pursuit of quality independent financial advice and business excellence, it is here to stay, for sure.

And the two things you must know about FAQC? Our financial consultants value it, and you are the reason why they strive for it.